How is Your Credit Score Calculated?

Your credit score is a number based on a formula using the information in your credit report. The result is an accurate forecast of how likely you are to pay your bills.

Your Credit Score Considers Five Areas of your Credit History

As the video below explains, your credit score is calculated using five major components, with varying levels of importance. These credit score factors, with their relative weights, are:

Payment history (35%)

Amount owed (30%)

Length of credit history (15%)

Credit mix (10%)

New credit (10%)

All of these categories are taken into account in your overall score. No one factor or incident determines it completely.

Why Credit Scores are Important

Credit scores are especially important if you are considering applying for any type of loan. If you’ve gotten a loan, a credit card, or even auto insurance, the rate you paid was directly related to your credit score.

The higher the score, the better you look to lenders.

People with the highest scores get the lowest interest rates.

Credit Score or FICO Score?

You might hear the term “credit score” often referred to as a “FICO Score” but the terms mean the same thing.

A FICO Score is a proprietary tool created by the data analytics company FICO.

FICO’s is not the only type of credit score available, but it is one of the most common measurements most used by lenders to determine the risk involved in doing business with a borrower.

How Do Lenders Use Credit Scores?

Your credit score communicates the idea of “risk.” That’s because credit scores are used by lenders to determine the risk involved in doing business with a borrower.

Credit scores look at the information that can predict your future behavior.

If you’ve been paying your bills on time for the past 25 years, you’re likely a low-risk person to lend to. In contrast, imagine you got your first credit card two years ago and have had four late payments during that time. Your balance on the card is at the credit limit. You have applied for new credit four times in the last six months. Based on these facts, you will have a lower score and are considered a higher risk.

Credit scores can and do change. Often, a negative item on a credit report can result in a quick and sudden decrease in the score. However, improving a credit score usually takes time and patience. There is no “quick fix” for damaged credit.

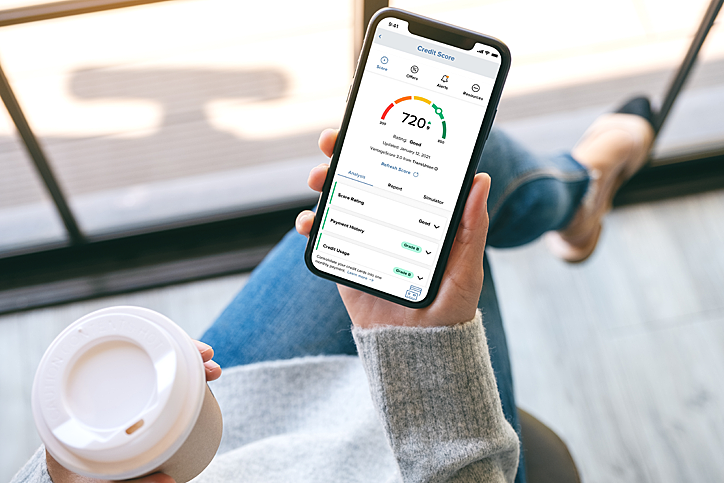

Free Access to Credit Score and Report

Fortera members have instant access inside their online and mobile banking to their credit score and credit report along with personalized tips on how to improve their score or maintain an already great score. Click here to learn more.